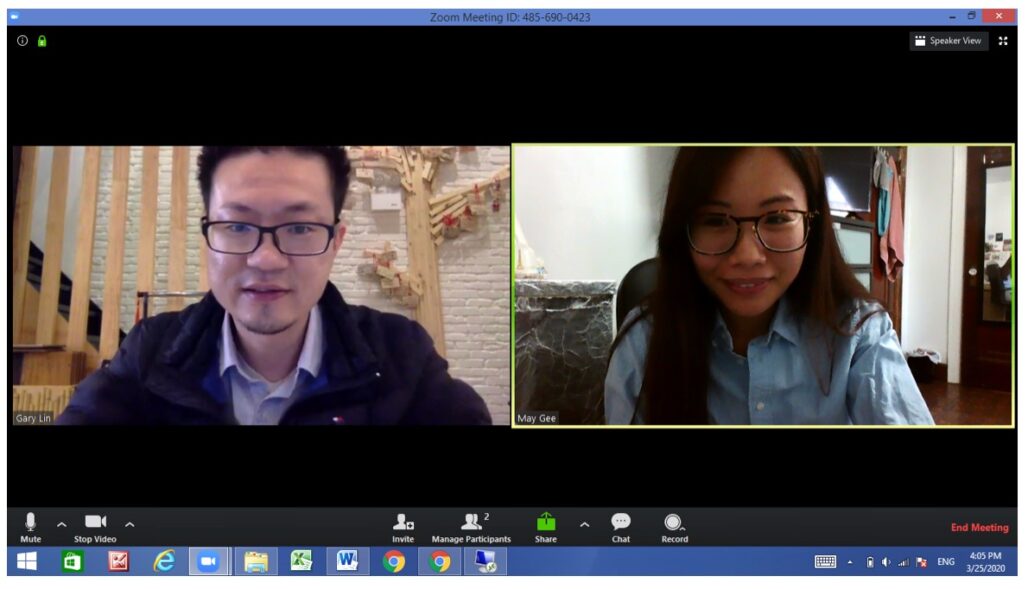

Image: Lin Guo Yao (Gary Lin), owner of Kyu Ramen, met via Zoom with REDC’s May Gee.

Renaissance Economic Development Corporation (REDC) is moving quickly to deliver low-interest loans to small businesses throughout New York City damaged by the economic fallout from COVID-19. Just days after launching an Emergency Small Business Relief Loan Fund, REDC closed its first loan Monday, March 30 with a business owner in Flushing, Queens. REDC, an affiliate of Asian Americans for Equality (AAFE), has a long track record as a first responder in times of crisis, swiftly getting emergency funding into the community at critical times.

Since making multilingual interest forms available March 18, REDC has received more than 400 requests for loans from businesses forced to close or drastically downsize due to the coronavirus outbreak. The emergency funds are providing endangered businesses with immediate working capital, up to $50,000, to make looming rent payments and payroll. In many cases, businesses may eventually receive additional funding from city, state or federal government agencies. REDC’s emergency loan program is designed to sustain them in the interim.

While in-person meetings have always been a requirement to close small business loans, REDC staff members have been adhering to New York State’s social distancing orders and are working remotely. In the past two weeks, they came up with a virtual system for meeting with small business clients and completing loan documents via video conferencing and by obtaining electronic signatures.

The first emergency loan recipient is Lin Guo Yao (Gary Lin), owner of Kyu Ramen in Flushing. The Japanese restaurant and bubble tea shop has been in business since March of 2019. Like many other restaurants in New York City, Kyu Ramen was forced to severely scale back operations after Gov. Andrew Cuomo issued a shutdown order on all dining-in restaurants. Mr. Lin said, “Renaissance (AAFE) offered me an emergency loan in a really short period of time when the company needed the cash flow the most. This emergency loan is like a gift in a most difficult crisis (and) solves our urgent needs.” (在公司最需要现金的时候,亚洲人平等会以最快的速度给我们提供了小额商业贷款,真的是雪中送炭解決了我们的燃眉之急。)

During the COVID-19 crisis, REDC is drawing on more than two decades of experience as a trusted community-based partner for immigrant small businesses when they have needed it the most. After the September 11th attacks, REDC dispersed more than $12 million in loans to distressed Chinatown businesses, helping to stabilize Lower Manhattan’s economy. Following Hurricane Sandy, REDC helped hard-hit businesses across the city with nearly $5 million in emergency loans.

“COVID-19 is a public health emergency, but also an economic crisis unlike anything our small businesses have ever faced,” said Thomas Yu and Jennifer Sun, co-executive directors of Asian Americans for Equality. “Our essential small businesses need help right away if they are going to survive. This is why we launched the COVID-19 emergency fund — to give business owners in our immigrant neighborhoods a fighting chance until government assistance arrives. ”

“Long before New York began shutting down to fight the coronavirus outbreak, our small business owners in Manhattan’s Chinatown, Flushing and Sunset Park were pushed to the brink as their customer base all but collapsed,” said Jessie Lee, managing director of Renaissance Economic Development Corporation. “Our team is working quickly to provide them with critical initial funding and to help open doors to other financial resources as they become available.”

REDC’s Emergency Small Business Relief Loan Fund is available to companies with 50 employees or less that can demonstrate at least a 25% drop in sales due to COVID-19. Businesses must be located in one of the following neighborhoods: Manhattan Chinatown/Lower East Side, East Midtown (32nd Street-Koreatown), Flushing, Jackson Heights, Elmhurst, Murray Hill (Queens), Woodside, College Point, Bayside, Sunset Park, Bensonhurst, Bay Ridge and Sheepshead Bay. Loans are available up to $50,000 at a fixed interest rate of 3%.

For more fund information, see details on REDC’s website (English, Chinese, Korean and Spanish). Business owners must complete an interest form online to be considered for a loan (English, Chinese, Korean, Spanish).

More than $3 million has been raised from REDC partners so far and $1.5 million in existing funding was re-allocated to the emergency fund. In addition, AAFE donated the proceeds from its annual Lunar New Year Banquet to the COVID-19 fund (the event was cancelled due to restrictions on large public gatherings, but ticket holders generously agreed to support REDC’s small business initiative). An independent grassroots group has raised nearly $30,000 for the fund from over 570 donors via GoFundMe.

Given the difficult situation faced by almost all small businesses, there has been high interest in the loan fund. New requests for funding are coming in every day. AAFE and REDC are continuing to seek additional loan capital to expand the emergency fund.